A First Look into Private Debt

Patrick Warren, Burgiss

The current Burgiss Manager Universe (BMU) covers over 1,150 private debt funds with capital exceeding $1 trillion, yet despite its size and importance, the private debt markets remain relatively opaque. In this post, we take a granular look at loan-level data from the BMU to document some of the characteristics of private debt.

The BMU includes almost 23,000 private loans that total $2.23 trillion in value. These loans were issued to nearly 12,600 holding companies and are held by more than 1,240 funds. At Burgiss, we collect extensive information about these loans, providing unparalleled insight into the details of private credit. We gather information such as investment date, maturity date, market value, cost basis, proceeds, and seniority, as well as whether a loan is secured, convertible, or has a fixed or floating rate. For fixed-rate loans, we record the coupon, and for floating-rate loans, we record the spread and its index.

Our data reveals that private debt is quite concentrated along some important dimensions. Commentators generally acknowledge that private debt is primarily floating-rate, and our data reveals how overwhelmingly true this is—over 80% of private loans (by value) are benchmarked to a reference index. Just 14% of the BMU is composed of fixed-rate loans, and slightly over 2% are complex loans, which can combine fixed- and floating-rate components. While lenders may be worried about duration risk in the current interest rate environment, it does not appear to be a major threat to private debt returns.

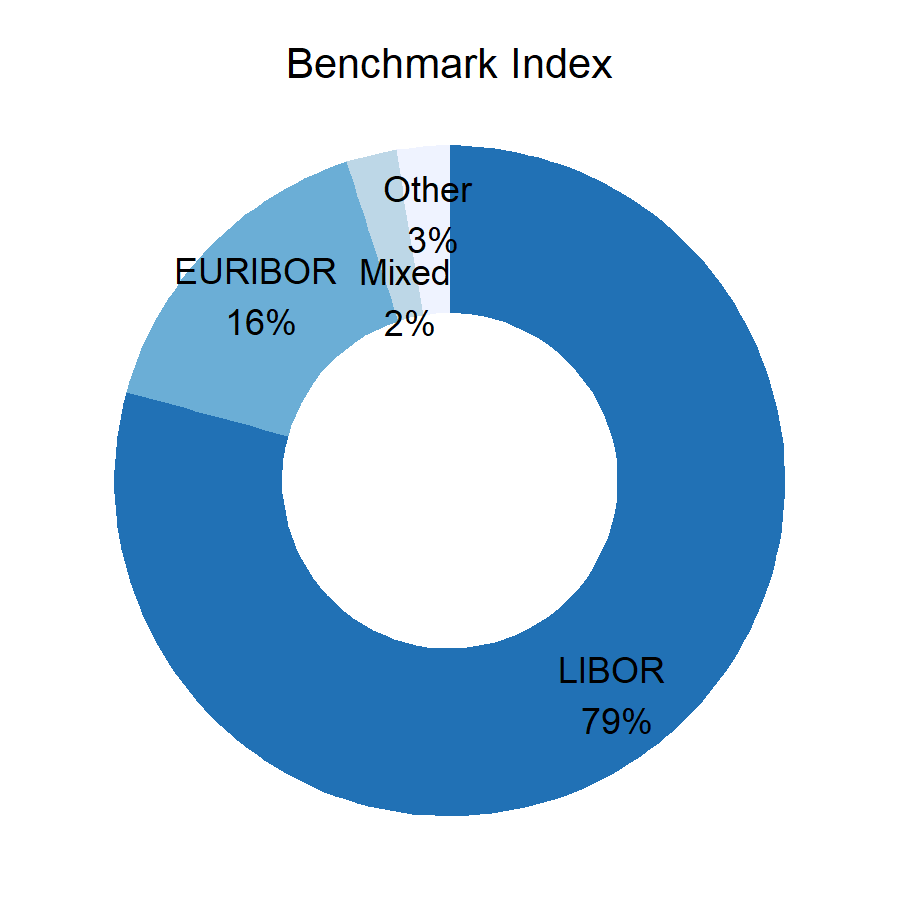

Within floating-rate loans, LIBOR remained the dominant reference rate in both 2020 and 2021. EURIBOR already indexes a significant share of private debt and will largely supplant LIBOR in the European context—but we have yet to see SOFR make such inroads in U.S. dollar private debt. However, we expect dollar-denominated private lending to rapidly adopt SOFR in 2022.

Seniority is an additional dimension along which allocators may want to diversify, but this is challenging when it comes to private debt. Over 80% of private debt is senior, while just 16% is mezzanine. Those who are willing to tolerate a lower payment priority are looking at a relatively narrow slice of the private debt markets. However, senior loans encompass a wide range of risks, which we will address in future research.

While private debt markets are dominated by floating-rate and senior debt, there are other dimensions that Limited Partners should consider when allocating capital. In future blog posts, we will further explore securities-level data in the BMU and its implications for private debt investors.

NOTE: Shares of private loans by value. Percentages may not sum to 100 due to rounding.