Q4 2022 Results Are In: Private Equity, Debt, and Real Asset Funds Up; Venture Capital Down; Dry Powder Remains High

Here are some of the highlights from our Q4 2022 update to the Burgiss Manager Universe (BMU):

View webinar recording: Q4 Private Capital Review Webinar

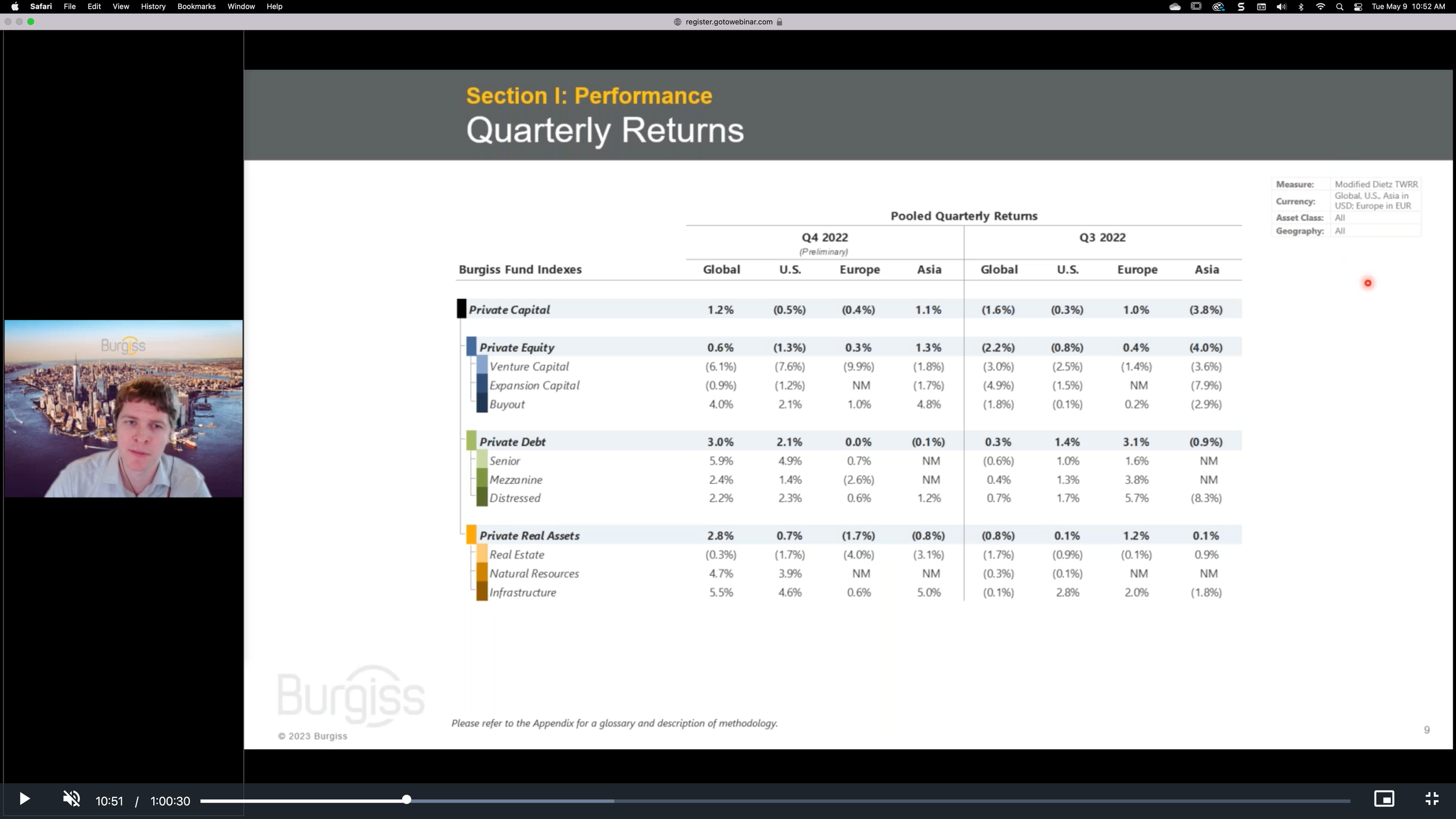

By the end of Q4 2022, quarterly returns for Global Private Equity funds were up 0.6%, with Buyout funds up 4.0% and Venture Capital funds down 6.1%.

Global Private Equity fund 1-year returns saw an 8.2% decline, while Global Private Debt fund 1-year returns rose 2.8% and Global Private Real Assets fund 1-year returns were up 8.2%.

In aggregate, Global Private Capital funds saw the lowest relative distributions since the Global Financial Crisis in 2008, with only 13% of value getting distributed throughout 2022. With the exception of 2020 at 18%, the distribution rate has been between 20–30% every year in the past decade and was at 28% in 2021.

At year end, dry powder, at $1.85 trillion, remains near its all-time high of $1.88 trillion at the end of the previous quarter.

Source: Q4 2022 Burgiss Global Private Capital Performance Summary

For additional information about these key takeaways and more, see the Burgiss Global Private Capital Performance Summary. Burgiss clients can access the full version of this and other BMU-based reports on the Private i Platform’s homepage or in the Caissa Platform’s Knowledge Center.

The Burgiss Manager Universe Q4 2022 results are based on since inception quarterly returns and cash flow data for over 12,900 private capital funds with a capitalization of more than $10 trillion and provides the most comprehensive, accurate, and up-to-date insights into private capital performance.

During our Q4 2022 Burgiss Global Private Capital Review webinar on Monday, May 8, at 10 AM ET, we discussed the latest in private capital performance and strategy trends as well as took an initial look into carbon intensity figures from the BMU. We also dissected how the usage of subscription lines has evolved over the past few years, and what this evolution could mean for IRRs. Read more information about the webinar here.