Subscription Lines of Credit, Part One: The Rise (and Rise) of Sub Lines

By Patrick Warren, Burgiss

Key Takeaways

Funds are growing increasingly comfortable with utilizing subscription lines of credit (also known as “sub lines”), with the majority of young Buyout, Debt, and Real Estate funds carrying sub line balances in 2022.

By contrast, Venture Capital funds have been slower to adopt sub lines, with just a quarter of young funds partaking, according to the most recent data.

Sub line usage is heavily front-loaded in a fund’s life, yet we still observe funds reporting sub line balances well after the end of their investment periods.

While sub lines have become an integral part of private capital markets, the discussion of their rise has been more qualitative than quantitative. Like much of the private asset space, data is hard to come by and detailed descriptions of sub lines remain challenging. This is the first in a series of articles that will lay out empirical results on sub lines. To start off the series, we examine the utilization of sub lines based on Holdings data from the Burgiss Manager Universe (BMU).[1] This dataset contains information on fund holdings along with balance sheet items such as cash and liabilities, including sub lines. With this unparalleled visibility into fund holdings, we can quantify several aspects of how General Partners (GPs) use sub lines, including prevalence and magnitude, and determine the implications for Limited Partners (LPs). In this article, we document the growing ubiquity of sub lines in Buyout, Debt, and Real Estate funds in contrast to the lagging uptake in Venture Capital funds.

As a simple starting point for our exploration of sub lines, figure 1 charts the trajectory of sub line usage using all funds per strategy in the BMU Holdings data. The results conflate two trends: (1) the rise of sub line usage and (2) how the composition of funds changes over time.[2] Here, “usage” denotes the number of funds drawing on their sub lines each quarter.[3] Figure 1 captures the rise of sub lines, first by Real Estate funds before the Global Financial Crisis (GFC), and then by Buyout and Debt funds. While over 30% of funds in these three strategies use sub lines today, only 10% of funds in Venture Capital use them, as GPs in the space have been less proactive in managing capital calls. The trends in figure 1 evince the growing importance of sub lines in private capital, but they also understate their prevalence in some ways. Funds often use sub lines as bridge financing for capital calls, and capital calls are extremely front-loaded in a fund’s life.

Figure 1: The fraction of funds using a sub line in a given quarter

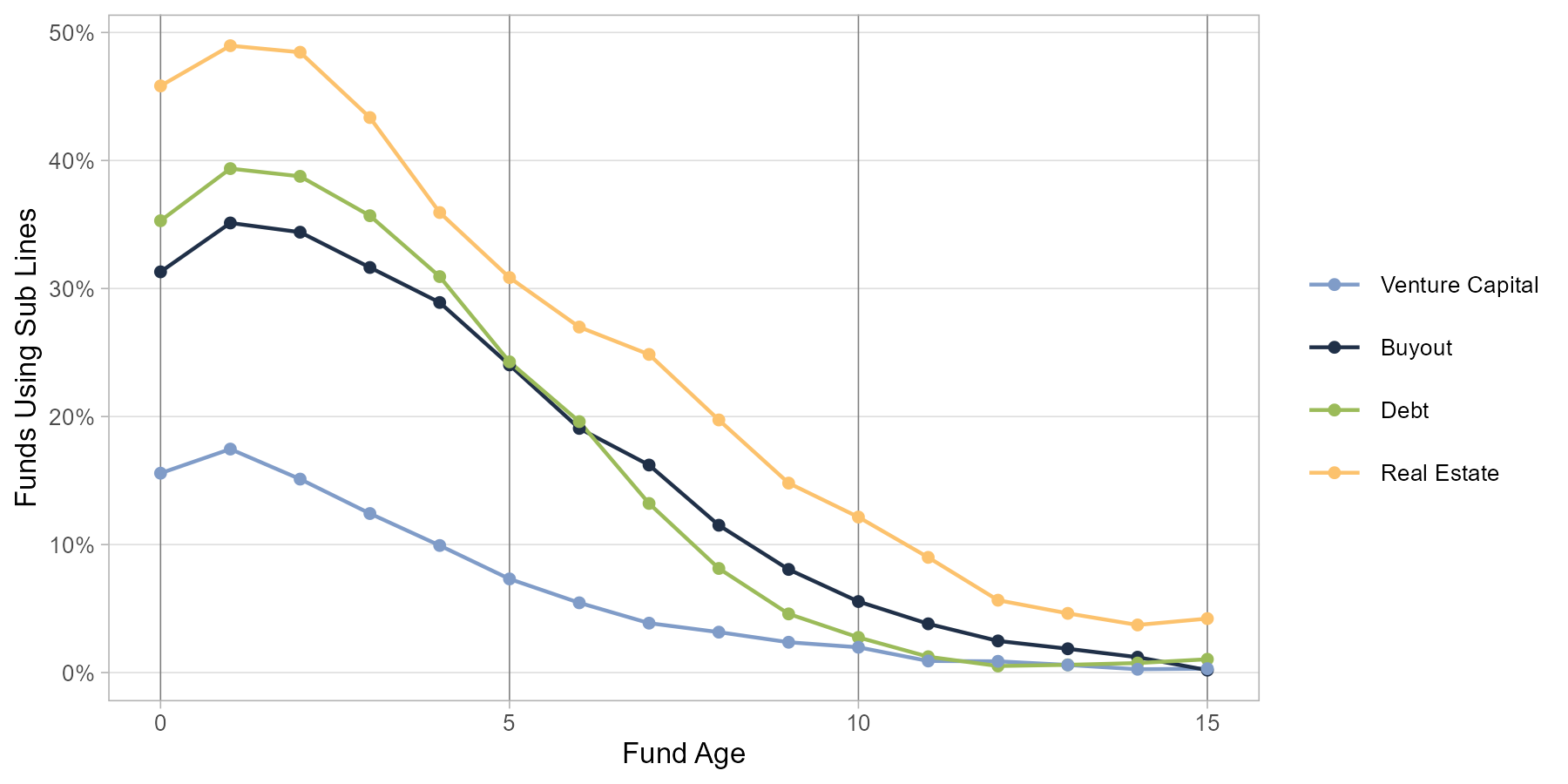

Figure 2: The fraction of funds using a sub line at each age

As figure 2 makes clear, sub line usage is extremely common in a fund’s first few years. But surprisingly, it is not uncommon for funds that are past—or sometimes long past—their initial investment phase to still carry a sub line balance. While 25–30% of Buyout, Debt, and Real Estate funds are utilizing sub lines at age five, we also see some funds making sub line draws after age ten.[4] For example, figure 1 shows that 33% of Buyout funds are using a sub line in Q4 2022, but it is important to note that this percentage includes many funds that are long past the age we would expect them to use sub lines.[5] What we are seeing in figure 1 is actually an accumulation of old funds that are done with their sub lines, which depresses the share of funds using sub lines and masks the true rise of sub lines.[6] To more clearly assess how sub line usage is evolving over time, we need to disentangle the trend from compositional changes using a different approach.

Figure 3: The fraction of one-year-old funds using sub lines each year

To avoid changes in composition, figure 3 plots the evolution of sub line usage looking only at one-year-old funds. At age one, funds are far more likely than at any other time to draw on their sub lines, but we can now clearly see the recent rise of sub lines. While Real Estate funds were the first to experiment with sub lines in 2002, Buyout and Debt funds soon followed in 2003 and 2007, respectively. By the end of 2022, approximately 75% of young Buyout and Real Estate funds were utilizing sub lines. However, Venture Capital funds stand out here for their comparative dearth; instead of using sub lines to make investments and later call the requisite capital from LPs, we observe many GPs for Venture Capital funds calling a chunk of capital in advance and then investing that money over the next few quarters. This is an interesting difference in cash flow management strategies that we intend to investigate further in future research.

Conclusion

The data we have presented on sub line usage confirms that sub lines are a growing force in private markets. While a GP’s decision to use sub lines is important, it is only part of the story. In our next article in this series, we will explore how intensively (as a percentage of committed capital) GPs are drawing on their sub lines, and present evidence that sub lines are in fact playing a much greater role in cash flow management than they did in the recent past.

[1] The BMU has since inception cash flow data for over 13,000 private capital funds and visibility into more than 230,000 of their underlying holdings. In this article, we focus on the set of funds where we have holdings data for since inception funds, including balance sheet items; this allows us to have an unbiased look at sub line prevalence.

[2] Because sub line balances are detailed in a fund’s quarterly reports, we are unable to observe any sub line draw that is executed and extinguished entirely within a single quarter. Thus, the estimates in this article represent a lower bound of sub line prevalence.

[3] We consider any sub line draw to be a use of the sub line, no matter how small. Using a low threshold such as 1% of the fund size to exclude de minimis sub line usage makes no meaningful difference to our results.

[4] The right tails of sub line-using funds in Buyout and Real Estate, with funds over age ten still drawing on sub lines, may be surprising. This reflects, in part, a small proportion of long-hold funds that have roughly double the target life of a standard fund, but more importantly, the ongoing use of sub lines to consolidate fees charged to LPs. Even at age five, funds are generally past their investment period, though we found many funds continuing to make investments facilitated by sub lines. In our next article, we will present evidence that sub line usage around age five is in large part for fees.

[5] This is also true of figure 2; while approximately 45% of Real Estate funds use sub lines in their first year, this includes funds from the vintage year 2000, before sub lines were prevalent.

[6] This is analogous to the composition issues we addressed in a previous article: Where Have All the Cash Flows Gone?.