Indexes, Investability and Self-financing Strategies

Traditional indexes for private capital are constructed by compounding short-term pooled returns (IRRs or TWRRs) giving a time-series of index levels over a long period of time. Creating an index in this way gives rise to a number of natural questions centered on whether such an index is investable, and the related question of whether it accurately tracks wealth outcomes.

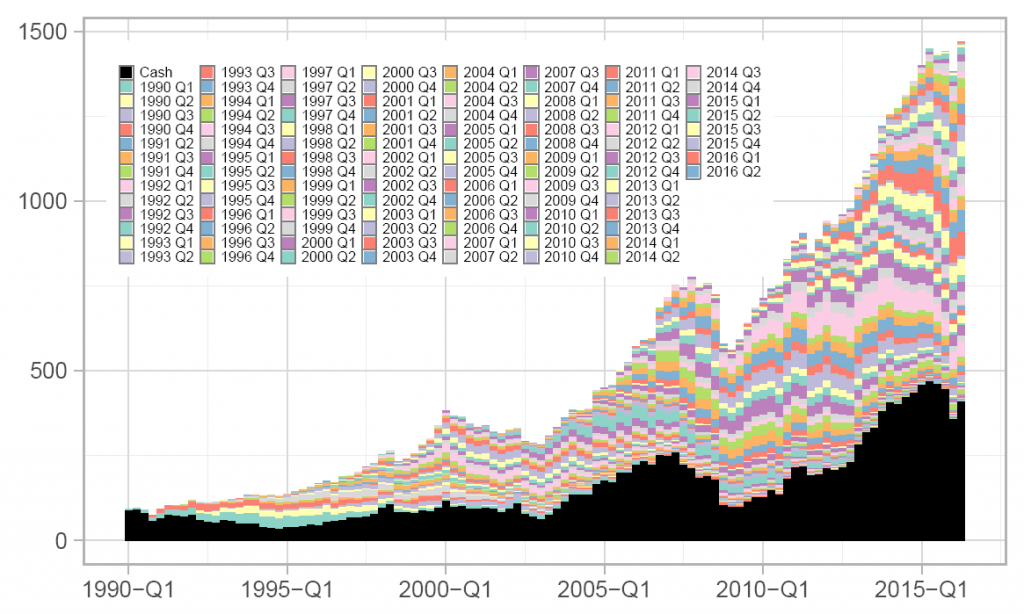

This paper starts by examining whether such an index, based on pooled data, can be replicated. Because of the dependence on interim fund valuations it turns out that the index is not replicable, although one can come close. The paper continues to examine investability by investigating the funding requirements of an index. It emerges that traditional indexes tend to not be self-financing, generating large swings in how much capital is needed, or how much capital is returned to the investor. Finally, the paper compares the behavior of an index with that of a “strategy”, namely a simulation that explicitly tracks investments in private capital by accounting for commitments and all cash flows, while keeping undeployed capital in a more liquid form (such as a public equity index). The behavior of such a strategy is illustrated in the diagram at right.