Endurance of Internal Rate of Return

Performance measurement of private capital investments has been an ongoing challenge for asset owners, asset managers, and investment consultants alike.

The fundamental challenge in measuring the performance of private capital investments is that investors do not know precisely at a given point in time 1) how much capital is invested, or, colloquially speaking, is “in the ground”, 2) how long the capital is invested, or 3) what is the rate-of-return on the capital. For these reasons, the performance of private capital investments is not understood in the same way as returns in the public markets, where everything is known precisely at every point in time.

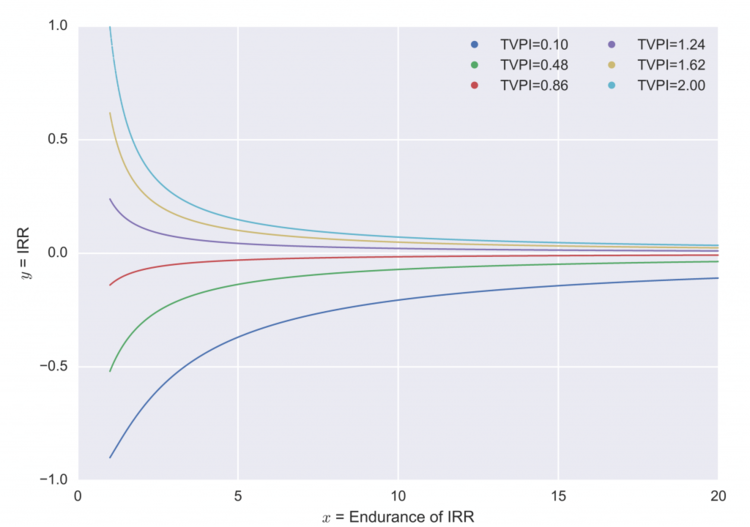

In this paper we investigate a time-duration measure – dubbed endurance of IRR – to accompany IRR so that it can be understood in the same way as returns in the public market. We define endurance of IRR as a length of time for which IRR effectively compounds the total contributions to yield the total distributions.

Endurance of IRR is always a positive number less than or equal to the age of the underlying fund at the time of performance measurement. We believe mentioning IRR along with its endurance can enhance its understanding thus making it a more useful measure of investment performance.

Click here to download your copy.