New Frontiers in Carbon Footprinting: Private Equity and Debt Funds

Rumi Mahmood, MSCI and Abdulla Zaid, Burgiss

Key Takeaways

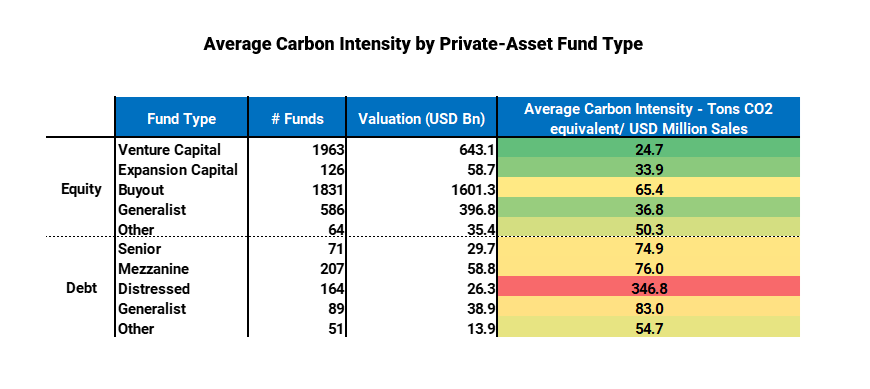

Expansion Capital and Venture Capital funds[1] exhibited the lowest average carbon intensities.

Distressed Debt funds showed exceptionally high levels of carbon intensity.

The average carbon intensity of the Utilities sector was 30 times the overall average.

Ahead of COP 26, nearly 90 private asset managers representing over USD 700 billion in assets under management signed the UN PRI’s Initiative Climate International, which aims to accelerate the transition to net-zero emissions [1]. In this regard, the ability of private capital markets’ participants to quickly deploy vast amounts of capital toward specific targets — coupled with the industry’s record levels of cash waiting to be invested — makes them potentially powerful agents of change [2]. But before heading to a destination, it’s important to know where we stand today.

Globally, investors have sharpened their focus on the financial impact of climate change on their portfolios. Though climate risk affects every asset, addressing it has been particularly challenging with private portfolios, due to the inherent opacity that characterizes much of this space. As with all things climate-related, data is integral to solutions. To gauge the potential climate-transition risk in private funds, MSCI partnered with Burgiss to estimate the Scope 1 and 2 carbon-emission intensities of private equity and debt funds’ holdings.

We estimated carbon-emission intensities for companies with reported revenue figures in the Burgiss Transparency Database [3]. Held across 5,152 private funds, the holdings’ aggregate valuation was USD 2.9 trillion as of November 2021, representing approximately 76% of the private equity and debt funds’ total valuation within the Burgiss Manager Universe [4].

Data as of November 2021. The analysis is based on the aggregated underlying holdings’ valuation of USD 2.9 trillion held across 5,152 funds. Source: MSCI ESG Research LLC, Burgiss LLC

Expansion Capital[1] and Venture Capital funds exhibited the lowest average carbon intensities, by virtue of their relative focus on industries with inherently low intensity. On an aggregated basis, 54% of these funds’ holdings valuation was in Information Technology and Communication Services.

Distressed debt funds showed exceptionally high levels of carbon intensity, driven by their higher exposure to carbon-intensive sectors, with 15% of their aggregated underlying holdings’ valuation in Energy, Materials and Utilities. Mezzanine and Senior debt funds exhibited much lower levels, as their sector exposures to Utilities, Materials and Energy sectors stood at just 7% and 8%, respectively.

At the underlying sector level, Utilities showed a remarkably high average intensity level. Emission intensities attributable to the Materials and Energy sectors were at 477 and 324 tons of CO2 equivalent/USD 1 million sales, respectively, while utilities intensities reached 1,655 tons CO2 equivalent/USD 1 million sales, or roughly 30 times the overall average.

Data as of November 2021. The analysis is based on the aggregated underlying holdings’ valuation of USD 2.9 trillion held across 5,152 funds. Source: MSCI ESG Research LLC, Burgiss LLC

Data as of November 2021. The analysis is based on the aggregated underlying holdings’ valuation of USD 2.9 trillion held across 5,152 funds. Source: MSCI ESG Research LLC, Burgiss LLC

Developed market exposure dominated; the geographic mapping of the dataset indicated that most fund types were predominantly exposed to North America and Europe, with 61% and 21% of the aggregated underlying holdings’ valuation in these regions, respectively, while there was very little exposure to emerging markets.

Data as of November 2021. The analysis is based on the aggregated underlying holdings’ valuation of USD 2.9 trillion held across 5,152 funds. Source: MSCI ESG Research LLC, Burgiss LLC

Moving Ahead

With increased demand for climate-related information at the company level, we are in the midst of monumental shifts in capital allocation. The measurement of carbon emissions in private capital is crucial for limited partners to realistically evaluate the environmental exposures and risks in their portfolios. Emission measurements serve as a necessary first step for limited partners to engage with their fund managers and portfolio companies on climate risks and opportunities, especially as private investments become more integral to the net-zero transition.

The authors thank Keith Crouch and Luis O’Shea from Burgiss for their contributions to this blog post.

Additional Reading

Carbon Footprinting of Private Equity and Debt Funds

Understanding Exposure in Private Assets

Burgiss and MSCI Discuss the Net-Zero Journey for Private Asset Investors

[1] “Nearly 90 private- equity firms representing $700 billion AUM have signed up to a global climate initiative ahead of COP26.” UN PRI, March 26, 2021.

[2] “Burgiss Manager Universe Updated through Q2 2021.” Burgiss, Sept. 18, 2021.

[5] Asset Class, Sector, and Geography are all attributes which are assigned by Burgiss according to the Burgiss Private Capital Classification system. Asset Class is a fund-level field assigned based upon where a fund will invest its capital. Sector and Geography are company-level fields assigned based upon the focus and location of the company itself